| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 2 3 4 5 6 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #150656 - Ignore sandjco modified |

2/4/2020 8:25:47 AM My biggest nemesis in this trading adventure - me! The urge to date the next babe specially now with smartphones can be counterproductive. Broke my own rules due to curiosity and greed to not hold a stock/option over earnings. FB got screwed. GOOG was up 400% till I forgot earnings was EOD. AAPL after earnings put play worked and TSLA after earnings call play erased all my sins for the last century! Would TSLA Mar 900 calls break 1000%? My Hubris from the above (gains luckily outpacing the losers) may come back to haunt me one day. I need to either: be disciplined to close the play before earnings or play after for the follow thru. GOOG on earnings day...  TSLA just keeps on rocking! Thank you Uncle Elon! Yes, there will be dips....but gonna ride you a long long time! The non-believers have been fuelling this rocket ship! And yes, they will revenge trade and yes, they may ride it down for a retracement one day...  SPXS has not hit my stops ($12). Token Feb SPY and QQQ puts are starting to erode.  Bought ZM Feb calls for earnings play; will close it today for over 400%  Coronavirus still the rage.... Trump Impeachment drama closing soon... Markets barely budged! |

| sandjco 648 posts msg #150661 - Ignore sandjco |

2/4/2020 3:58:00 PM TSLA! The next conviction buy of the decade?  Took 3/4 the contracts off the table for 4000% plus Will play the retracements as they come along. Still so many possibilities in the story... - shorts will still want to revenge short the biggest loss theyve had till they are exhausted. - 10 out of 23 analysts still has it as a sell - none of the big auto/truck co have been disrupted and gone out of business - no slowing down of the recharging station buildout - SP inclusion - low participation from MF who were non believers - No Samsung like me too competitors - future revenue streams from wireless updates have not been understood - insurance revenue stream - Model 3 is the first iPhone....it will be the model that will most likely open everything up for them Yes, there will be retracements....and yes, they will probably be nasty. Unless the fundamentals deteriorate....this would be a good stock to trade in and out IMHO. |

| sandjco 648 posts msg #150684 - Ignore sandjco |

2/6/2020 8:20:20 AM Back in the saddle with QQQ and RUSL   Dipping into VXX short using puts  Long XLNX  Out of SQ calls for over 200%  Out of TSLA calls still with profits but they sure evaporated as fast as they printed money. Will play another day. Gut said buy weekly puts but didn't wanna pay price. Village Elders' screen showed the signal. Will it dip into the $600s? https://www.stockfetcher.com/forums/Stock-Picks/Short-Sell-Filter/150208/99999  Still long ROKU and will probably add call options in a few days  Markets shaking of Coronavirus and Impeachment. MSFT AAPL AMZN did well. GOOG and FB were so so. |

| sandjco 648 posts msg #150723 - Ignore sandjco |

2/8/2020 5:46:35 PM RUSL with a 6% haircut; will have to be patient with this to get myself out the crapper!  QQQ with no follow thru...out; call it a wash  ROKU testing my patience...if it continues to fall; will add calls  Bailed on XLNX for a small profit  AAPL playing Mar 300P $4  TSLA  Trump lives to run another day... Coronavirus still in the background.... China slowdown? |

| sandjco 648 posts msg #150724 - Ignore sandjco |

2/8/2020 6:13:06 PM Danggit...cant edit! Long TLT Apr 150C  Out of VXX put experiment for a token loss  |

| sandjco 648 posts msg #150731 - Ignore sandjco |

2/10/2020 11:29:54 AM Will close AAPL put and play Mar 320C for $13.60. No follow thru on the downside. Playing WORK Mar 22C for $3.70 |

| sandjco 648 posts msg #150737 - Ignore sandjco |

2/10/2020 4:27:58 PM Out of WORK $5.50 for a quickie |

| xarlor 639 posts msg #150740 - Ignore xarlor |

2/10/2020 9:18:56 PM I hear Google is hiring sandjco /snicker |

| sandjco 648 posts msg #150741 - Ignore sandjco |

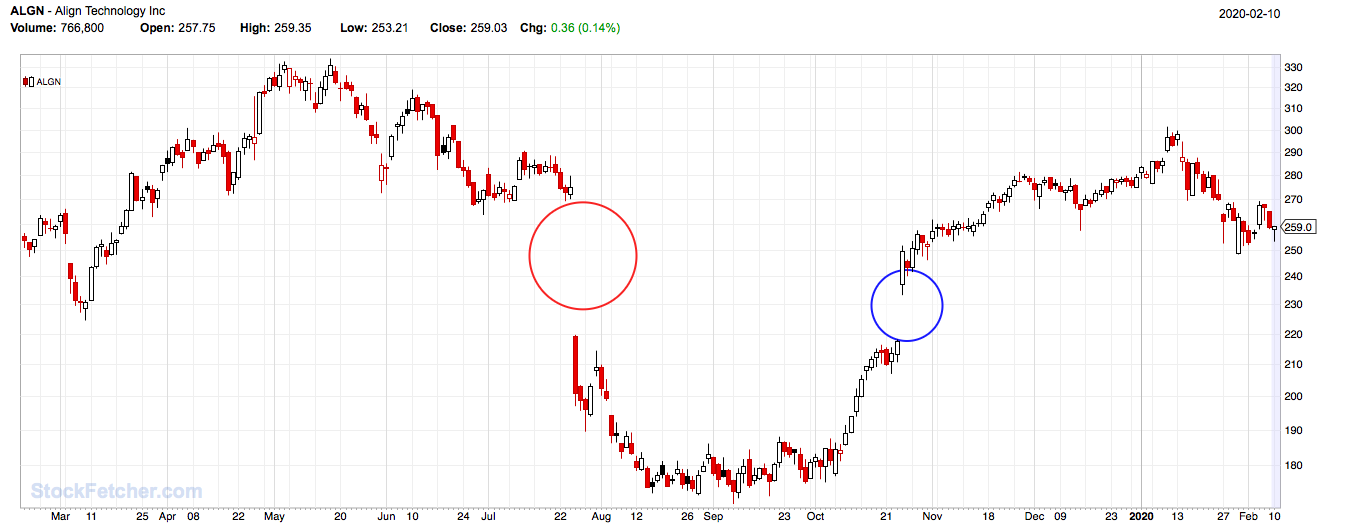

2/10/2020 10:05:47 PM Hahahaha! I was waiting for some smarty pants to say that after I posted the ticker! BTW...appreciate you helping those who cant code like me! QUESTION for the community: 1. Is there a filter that can spot GAPS either up or down say within the last X days? 2. Is there a filter wherein you could screen stocks using X degree angle (up or down) within the last x days? An example of GAPs would be ALGN  Thanks in advance! |

| svtsnakebitn 150 posts msg #150744 - Ignore svtsnakebitn |

2/11/2020 8:37:22 AM Hey @sandjco - awesome thread and youve really been killing it recently! Can you walk through your selection criteria? Looks like youre using the T3 as a guppy multi moving average? What triggers your buys? |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 2 3 4 5 6 ... 29 >>Post Follow-up |