| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 2 3 4 5 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #150081 - Ignore sandjco modified |

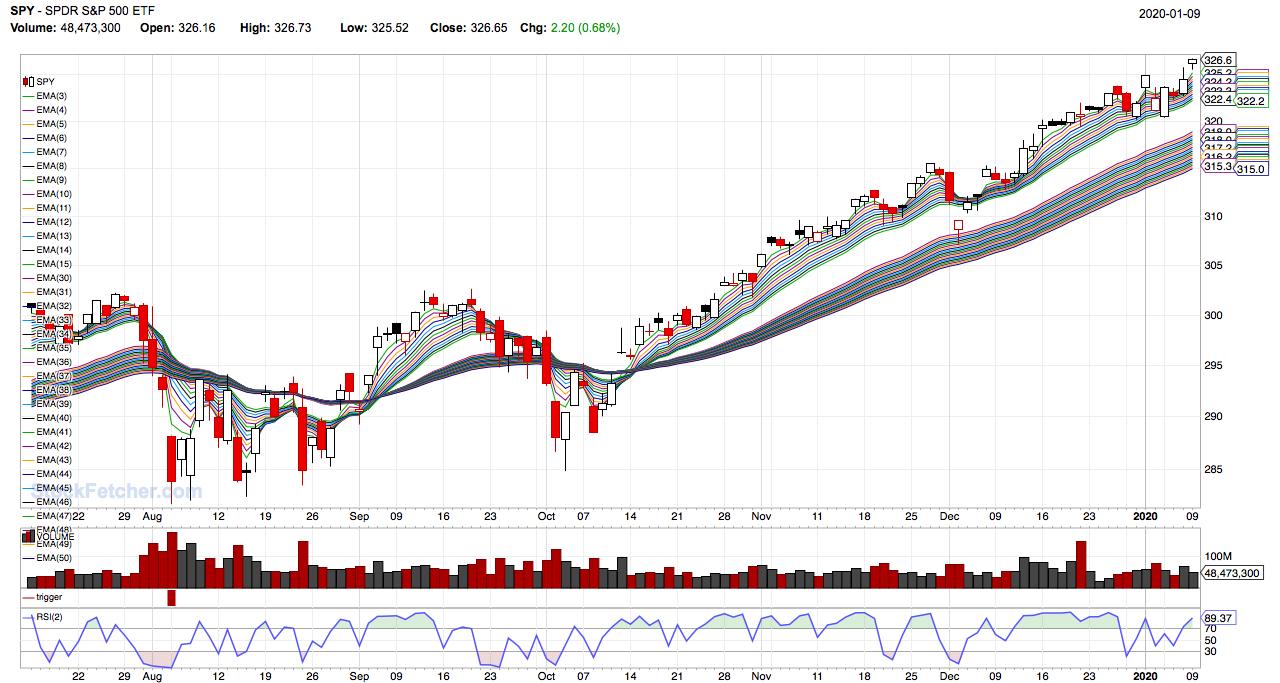

1/2/2020 6:32:51 PM Original thread https://www.stockfetcher.com/forums/Stock-Picks/A-Newbie-s-Journey/136535 Purpose: 1. Share picks so everyone here at SF can benefit. I may also benefit from someone else's idea and/or post. Something like a crowdsourced stock picking and I can track how we did over the years... 2. Anyone can post. Only thing I ask is to keep the discussion civil so as to make the thread easier to follow with less clutter. Who knows how long this thread will last...I would like to keep it going as long as I am able and as long as there is value in the discussion. Why? 1. My way of "paying it forward" to the kindness of the SF posters here who have been instrumental in my learning. Off the top of my head - xarlor, Mactheriverrat, Cheese, pthomas215, Nibor100, KSK8, graft, TRO, SAFeTRADE, WSG, shilllihs, johnpaulca, Kevin, davesaint86, four, snappyfrog, Eman93, mahkoh, SF staff, and...my apologies if I left anyone off. Each has their way of "teaching" based on their online personalities! 2. My way of recording (and learning) from trades that went well and trades that didn't (and learn from it) 3. So my kids can learn from what I have gone thru. 4. Keeps me on track How did I use SF? 1. Did my best to read as much as I could and digest. Not everything made sense (code, jargons, personalities, etc...) and till this date, I have not read and digested the important nuggets in SF. Prioritized the posters according to relevance, clarity and consistency of their calls. 2. Kept things simple. Played with the codes and concepts and took what I liked with what I was trying to trade (ETFs usually). 3. Practice and observe...write, re-write and test...rinse and repeat. 4. While a top level coding skill is wonderful...I discovered my very limited coding skills were more than adequate! 5. Understand there are those who freely share (and you wanna help back as well) and there are those... What did I learn about "trading" in the 2 years here? 1. While EVERYONE can see the same picture; not all of them will trade it the same way. 2. While EVERYONE can have the same filter; not all will be able to use them the same way. 3. Do not let expectations lead to belief (I was so used to taking money from the XIV ATM machine...till it blew up! Only prudent risk control prevented a massive implosion!) 4. Bears make money, Bulls make money....Pigs get slaughtered. 5. Always be learning because the market can humble you! My go to script... 1. It is NOT the holy grail guaranteed to make you riches! 2. I like the simplicity and how it looks visually; works for me. 3. Please feel free to suggest any improvements... 4. I do not necessarily use it to primarily screen picks....I am still trying to figure out a script for that (like a shopping list) that I could incorporate to this. GASX using EOD of $42.92  ROKU using EOD of $137.10  The market? What worry?  Traders back next week? What will happen when the "regulars" come back? |

| Cheese 1,374 posts msg #150096 - Ignore Cheese |

1/3/2020 12:41:28 PM sandjco, thank you for your threads and posts over the years. I've learned a lot of some of the trading info that you've shared. |

| shillllihs 6,102 posts msg #150112 - Ignore shillllihs modified |

1/4/2020 5:30:03 PM Nice job. |

| sandjco 648 posts msg #150140 - Ignore sandjco |

1/6/2020 8:53:16 AM Thanks guys! I forgot to thank Chetron! Could Soleimani death trigger the excuse for a correction? https://www.msn.com/en-us/news/world/was-attack-by-soleimani-imminent-before-u-s-killed-him-pompeo-dodges-the-question/ar-BBYDsm8?li=BBnbklE  Used Jan 320P $1.79  Used Jan 138C $1.78 Holding ROKU and GASX   Hitlist     |

| sandjco 648 posts msg #150149 - Ignore sandjco |

1/6/2020 2:13:20 PM And...forgot to thank Miketranz as well... msg #144623 9/10/2018 8:22:01 PM Here's a piece I wrote last year that just about sums it up. Welcome to Wall Street:The market's a set up,a shake out game by design,to siphon money from your account as rapidly as possible.The only reason it exists,in my opinion,is to extract large amounts of capitol,at the expense of the public.It's controlled by two elements,fear and greed,by a few of the largest institutions on the planet.86% of actively managed equity funds under perform the Standard & Poor. 95% of retail traders loss money,year after year,using the market as their private casino.Many day traders will wipe out their accounts within a year.The three main reasons for trading failure are 1)Lack of a solid plan,based on mathematical probabilities.2)Lack of money management skills,risk/reward factors.3)Lack of information.If your goal is to make money in the market,Stockfetcher has the tools at your disposable to do so.The market's a numbers game,not a guessing game,and until one realizes that,he will continually bleed money into the system.Miketranz.... Stumbled on this...  |

| sandjco 648 posts msg #150222 - Ignore sandjco |

1/9/2020 11:12:32 PM Ukrainian civilian jet shot down by Iranian missile? Markets barely budged and still kept moving up!  TLT and ROKU are testing my patience...   Closed GASX for a quick scalp close to the high but we will call it a wash  NVCR was a nice quick scalp  AYX, PLUG and TWLO went nuts with ATM calls busting more than doubles    Couldn't post the new trades on time   The craziest trade i made was with the AAPL Mar 400C that doubled in a day...crazy  |

| KSK8 561 posts msg #150225 - Ignore KSK8 |

1/10/2020 7:05:03 AM Hey sandjco, I had meant to reply to this thread earlier: So this looks like a very nice system and I am glad I could be of some use to its creation. One thing though: Regarding the line "count(close more than 3% below close 1 day ago,1)}" switch the 3% to 10%. The SSR ("Short-Sale Rule" or as I like to call it "Anti-Short Seller Criteria") doesn't get triggered unless the price falls 10% below its previous day close. Here's some more info regarding it: https://www.investopedia.com/terms/s/shortsalerule.asp |

| sandjco 648 posts msg #150228 - Ignore sandjco |

1/10/2020 9:11:34 AM Thanks KSK8 for dropping by! I did have it at 10% as you originally wrote. As I was visually and manually back testing it, it seems like it gave me less candidates to work with (which isn't bad necessarily and maybe I am being too "greedy" in "needing" more candidates to look at - which runs contrary to what I wanted to do (simplicity and being able to rinse and repeat!). For sure, the 10% calibration has tighter triggers but I lose options....therefore, I am torn as I do not have backtest capability (or the skills) to be able to run any monte carlo sim on the variables. A few of the posters here are really good at it seems like (Kevin comes to mind...but too bad he ain't here no more). I am even struggling right now on how to find/narrow down candidates to incorporate into my trading routine. Most of my picks are usually stocks that I've bought before or heard from different sources over time. As always, grateful for the feedback and always wanting to learn! |

| KSK8 561 posts msg #150254 - Ignore KSK8 |

1/11/2020 12:31:59 AM I understand where you're coming from. I would check out TRO's systems like RFR, GAP FILL, and MTC. Study the threads intensely. They are excellent if you are looking for instant profitability and simple rinse and repeat systems. Even after a decade of being around they still work very well, probably because they are statistically based filters. |

| sandjco 648 posts msg #150260 - Ignore sandjco |

1/11/2020 9:40:00 AM Thanks KSK8; appreciate it. It is just too bad those guys don't stick around and some threads gets bloated with no trade related stuff. I will look up those topics as per your suggestion. I am wanting to keep "emotions" out of the equation as well that is why your scripts and Village Elders' are piquing my interest right now. If you don't mind and not too much to ask, could you post your shorting filter here that you are currently using as there seems to be a few variants around for my reference? I'm trying to figure out how to catalogue filters that interests me over time. I am not comfortable with "short" selling concepts yet and I am watching with interest. From Village Elder /*https://www.stockfetcher.com/forums/Stock-Picks/Short-Sell-Filter/150208/99999*/ As always, I am grateful. |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 2 3 4 5 ... 29 >>Post Follow-up |