| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 5 6 7 8 9 ... 29 >>Post Follow-up |

| sandjco 648 posts msg #150876 - Ignore sandjco |

2/23/2020 12:01:21 PM Many thanks Xarlor! |

| sandjco 648 posts msg #150877 - Ignore sandjco |

2/23/2020 3:58:18 PM Ygritte to Snow "you know nothing John Snow"... I need to remind myself... Just when I think I got it...there are still really a lot more about trading that I really don't know and may never know. When my gut says it doesn't feel right; it probably isn't...praying it goes my way won't help. When I'm killing it...it doesn't mean a thing; just means my net worth has gone up for the day. I am only as good as the last trade. I've got this on a post it note in my home office....hmmm need to figure out how to do this with my phone! ;=P Let's see if I can avoid "derp" plays as Xarlor puts it from this day forward lol.... |

| sandjco 648 posts msg #150890 - Ignore sandjco |

2/24/2020 11:38:46 AM ENPH calls sold 3/4 position for $6.30; 50+% SPY puts sold 3/4 position for $15.50; 60% Absolutely fantastic day! Sold ROKU call; dead. Wanted to revenge trade....but holding back. I'll patiently wait for the bounce. I have to mentally learn not to be loyal on my fave stocks - they should be played to the short side as well. NVDA and TSLA were perfect examples of me wanting to go short on Friday but didn't as they have been super wonderful to me for a long long long while....it just kinda didn't feel right "shorting" them. Profit is profit...stocks, like ex wives, have no feelings! ;=P Patience...let the trade come to you.... |

| sandjco 648 posts msg #150917 - Ignore sandjco modified |

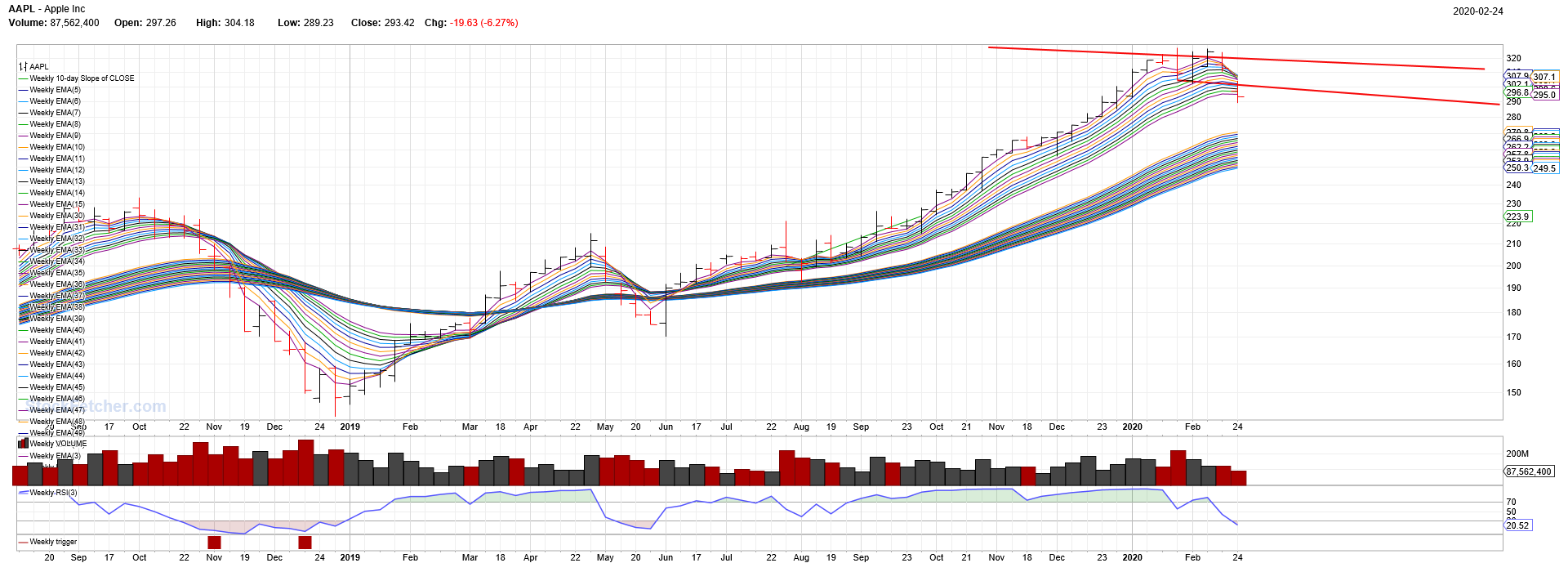

2/25/2020 2:15:18 PM Bought MSFT Mar 157.50P for $1.80  Bought AAPL Mar 300P for $10.55  Bought TLT May 140C for $11.40 looks like rates may drop to stimulate the Coronavirus economy....  May close my P anytime before EOD |

| sandjco 648 posts msg #150921 - Ignore sandjco |

2/25/2020 5:56:43 PM Closed 3/4 of the AAPL and MSFT P for > 50%. Will close the remainder tomorrow depending on what the action looks like in the morning. Sold 3/4 of the TLT C for small profit...will hold the remaining to see how it pans out. Looks like my tea leaves reading on this was not bad... https://www.stockfetcher.com/forums/Stock-Picks/Picks-and-Pans-Since-Jan-2020/150081/30 |

| sandjco 648 posts msg #150947 - Ignore sandjco |

2/27/2020 1:22:41 PM Will be closing the remaining MSFT and AAPL puts today for > 100% |

| sandjco 648 posts msg #150972 - Ignore sandjco modified |

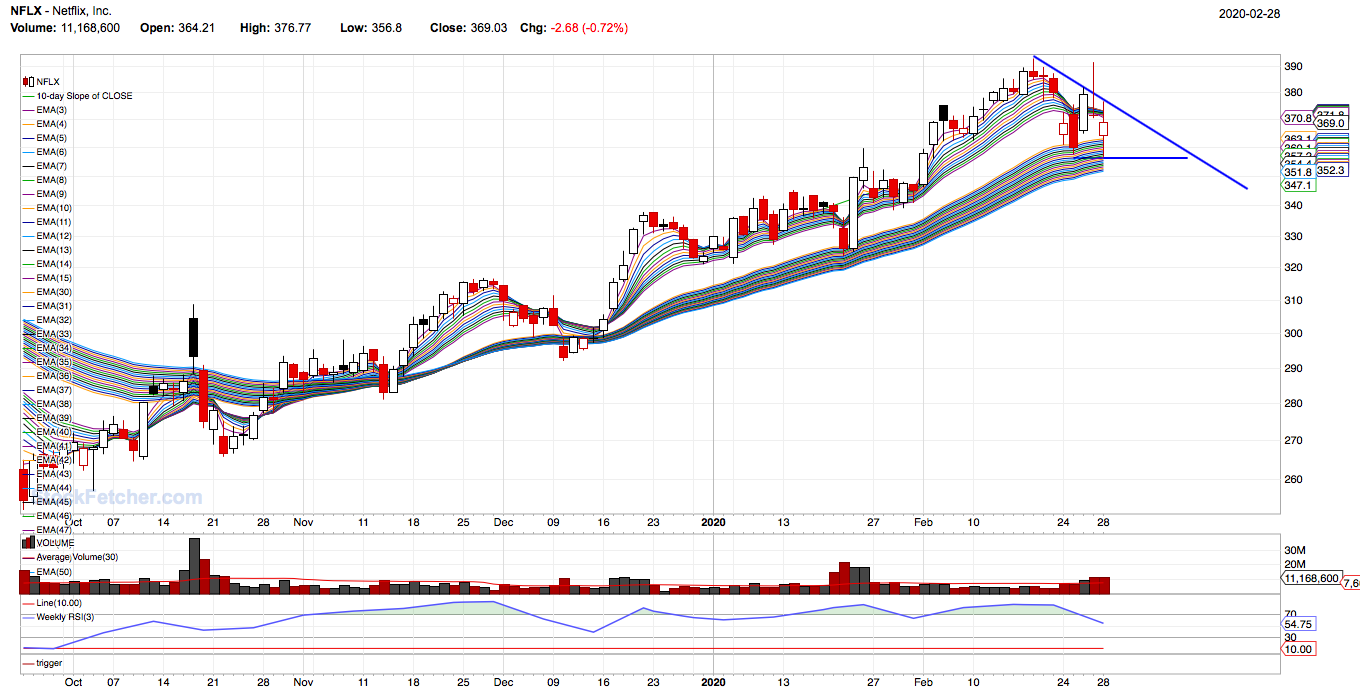

2/28/2020 8:04:29 AM On the road today but what an incredible week! Both MSFT and AAPL puts closed EOD for > 100%   All Cash. Note to self: - Maybe i should buy weeklies instead of buying a month out for bigger bangs (and could be derps).. - No need to try to catch the bottom; I just want to ride the right trend... Macro: - nothing on the political eco front - Coronavirus absolutely dominating the news spreading as far as Iran. - strangely enough, FXI hasn't had a major whooping!  Edit: I MAY short NFLX |

| xarlor 639 posts msg #150976 - Ignore xarlor |

2/28/2020 9:26:54 AM sanjco, what is your reasoning for shorting NFLX? Not trying to dissuade you, I just have the opposite in mind; long streaming services. My reasoning below. People are going to be staying home for extended periods as long as this virus is spreading. What can you do while stuck at home? So far, Chinese consumers are buying yoga mats, video games, and condoms. I imagine streaming will also be at the top of people's pastimes in coronaffected areas. |

| sandjco 648 posts msg #151004 - Ignore sandjco |

2/29/2020 1:30:18 PM Hi Xarlor, Thanks for asking; I appreciate you dropping by! I didn't get filled on my short order I placed before market opened (broke my do no trade on the 1st 15 minutes) as the price I was shooting for wasn't triggered at all ($382 I think the high 2 days ago). My logic was that it was: - bucking the selloff - day before had a big range but open almost = close on the bottom end - heard the virus story and while it MAY impact the price ..I don't really know when. - EMA 4 and 8 have crossed down - I was expecting (broke another rule of mine) that it will most likely break EMA21 which it did but closed up (which is making me think to think of a long bias on Monday maybe but the market is still bearish). In terms of my "plan": - assuming I got triggered at $382, my stop was going to be $390. - profit target was $360 or ride it as long as I could. Risking $8 to make $20++ I don't know how to post screen shots from trading view here otherwise, I would be happy to share my 15M chart. I chose not to use PUTs on this play as i knew I would have zero time to watch at all during the day and my cell signal was spotty at best. Hope that helps. As always...I welcome feedback! |

| sandjco 648 posts msg #151027 - Ignore sandjco |

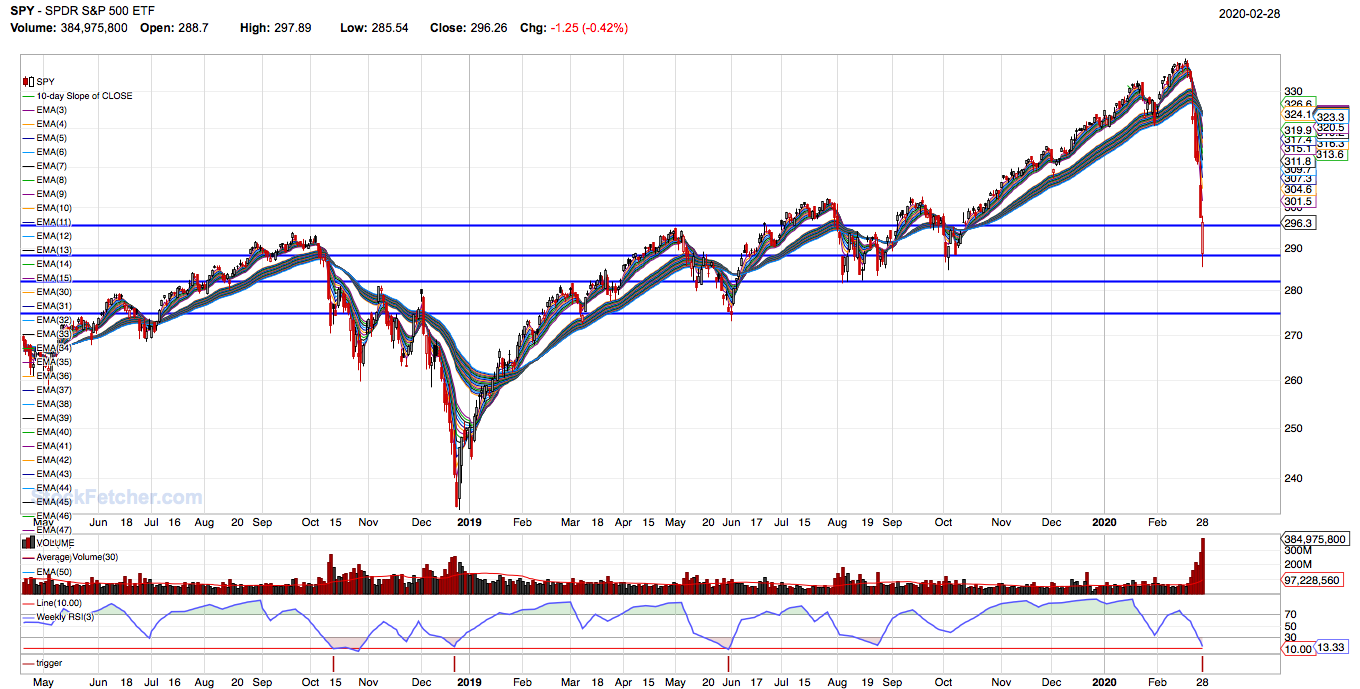

3/1/2020 5:45:23 PM How low will it go? 10% haircut a big deal or is it because 10% in points seems huge?  86,000 cases in 53 countries with 2,900 reported deaths https://news.yahoo.com/coronavirus This current haircut seems tame compared to Dec 2018 (China trade war which kinda became a non-event?) which was about 24% (will bring SPY to about 255 from 296 today). Longest correction apparently took 900 days to get over it. https://www.fool.com/investing/2016/09/18/the-funny-thing-about-stock-market-plunges.aspx As the adage goes...it is time in the market not timing the market that creates wealth apparently. Can technical analysis (when applied the way it is supposed to I guess) navigate the ups and downs and say...make the call to get back in the game and vice versa? Reminding myself...no need to rush to try to find the "bottom"...market can still be bought up and then sold off for the others a chance to bail. Let the game come to you...I tell myself. NFLX undecided where to go....  |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 5 6 7 8 9 ... 29 >>Post Follow-up |