| StockFetcher Forums · General Discussion · backtesting ideas | << 1 2 3 4 >>Post Follow-up |

| novacane32000 331 posts msg #157030 - Ignore novacane32000 modified |

6/18/2021 8:02:31 AM Just seeing now that this thread is getting some traction @Cheese-- I tried a few combinations on MACD slow/fast line crossovers and the results were so bad I stopped searching for a profitable combination. If anyone has a specific combo I can try to backtest it. I did try several combos of the MACD crossing the zero line and (12,26,9) had the best results. I use SPY as my benchmark for backtesting with the thinking that if it doesn’t work for SPY it won’t work for most equities . Here are the other MACD combos I used crossing above the zero line and then exiting on a cross below the signal line. (6,13,4) (10,20,6) (15,30,12) Again, none worked better than (12,26,9) and it also worked well for most stocks in the SP500. A few things I did find that I am now adding to all my backtest which reduces the max drawdown without too much sacrifice to net profit : 1) Take profit at 10% 2) Only take trades when price is above 150 MA 3) Instead of using a stop loss use the same signal you entered with to exit. So if for example you use a cross above RSI 2 ( ) to enter then use a cross below RSI 2 ( ) to exit. @Redversa --Thanks for sharing your results. Do you manually trade your signals or do you have an automated system? Also, does Marketinout allow you to optimize your backtest? I cannot do that on Trendspider. I have to enter every iteration manually. |

| Cheese 1,374 posts msg #157031 - Ignore Cheese |

6/18/2021 10:13:23 AM https://www.stockfetcher.com/forums/General-Discussion/backtesting-ideas/156926/20 novacane32000 modified 6/18/2021 8:02:31 AM MACD crossing the zero line ...none worked better than (12,26,9)... worked well for SPY, most stocks in the SP500. A few things reduces the max drawdown without too much sacrifice to net profit : 1) Take profit at 10% 2) Only take trades when price is above 150 MA 3) Instead of using a stop loss use the same signal you entered with to exit. So if for example you use a cross above RSI 2 ( ) to enter then use a cross below RSI 2 ( ) to exit. =============================================================================== @novacane32000 THANK YOU for your advice and backtest results ! |

| Cheese 1,374 posts msg #157032 - Ignore Cheese |

6/18/2021 10:42:33 AM @novacane32000, @Redversa @nibor100 and @graftonian You four are all experts at backtesting. Recently, karennma has found a TradingView author named QualQuantTrade (Sandy) who seems to be quite good in finding stocks showing signs of re-accumulation. Re-accumulation and rotation can be profitable. Have you done any works on Re-accumulation and/or rotation? Any thoughts ? Thank you. |

| novacane32000 331 posts msg #157036 - Ignore novacane32000 |

6/18/2021 2:06:02 PM I have been searching for a sector rotation strategy for (SPY,XLE,XLB,XLV,XLY,XLK,XLU,XLF,XLP,XLI). Every time I think I have something that works,it ends up that holding SPY worked better. |

| Cheese 1,374 posts msg #157039 - Ignore Cheese |

6/18/2021 5:53:05 PM novacane32000 6/18/2021 2:06:02 PM I have been searching for a sector rotation strategy for (SPY,XLE,XLB,XLV,XLY,XLK,XLU,XLF,XLP,XLI). Every time I think I have something that works,it ends up that holding SPY worked better. =============================================================================== Thank you, novacane32000 I also think your strategy is best. You cartainly have Warren Buffett as a great champion in your corner. |

| redversa721 157 posts msg #157044 - Ignore redversa721 |

6/18/2021 11:54:35 PM Novo " have been searching for a sector rotation strategy for (SPY,XLE,XLB,XLV,XLY,XLK,XLU,XLF,XLP,XLI). Every time I think I have something that works,it ends up that holding SPY worked better. " How about using. a combination of CMF(21) and a momentum. That should show if money is reducing in a sector Maybe something like this |

| Cheese 1,374 posts msg #157045 - Ignore Cheese |

6/19/2021 2:21:07 AM We may be talking about different kinds of rotation. Rotation from a waning sector of the 11 sectors and into a rising sector may be difficult. But rotation in and out of the same sector should be do-able. Rotation in and out of a sector and into an inverse should be do-able. Rotation in and out of a theme and into a negatively correlated theme should be do-able, e.g. back to work & return to normal vs work-from-home. An idea from glgene is MOO & UUP Often, I focused too much on SPY & QQQ and forgot about the importance of UUP My useless 2 cents |

| Cheese 1,374 posts msg #157046 - Ignore Cheese |

6/19/2021 2:34:21 AM Other excellent examples from Kevin_in_GA and davesaint86 about yet different kinds of rotation, e.g. spy,iwm,efa,agg MDY,SPY,QQQ,EFA etc |

| snappyfrog 751 posts msg #157048 - Ignore snappyfrog |

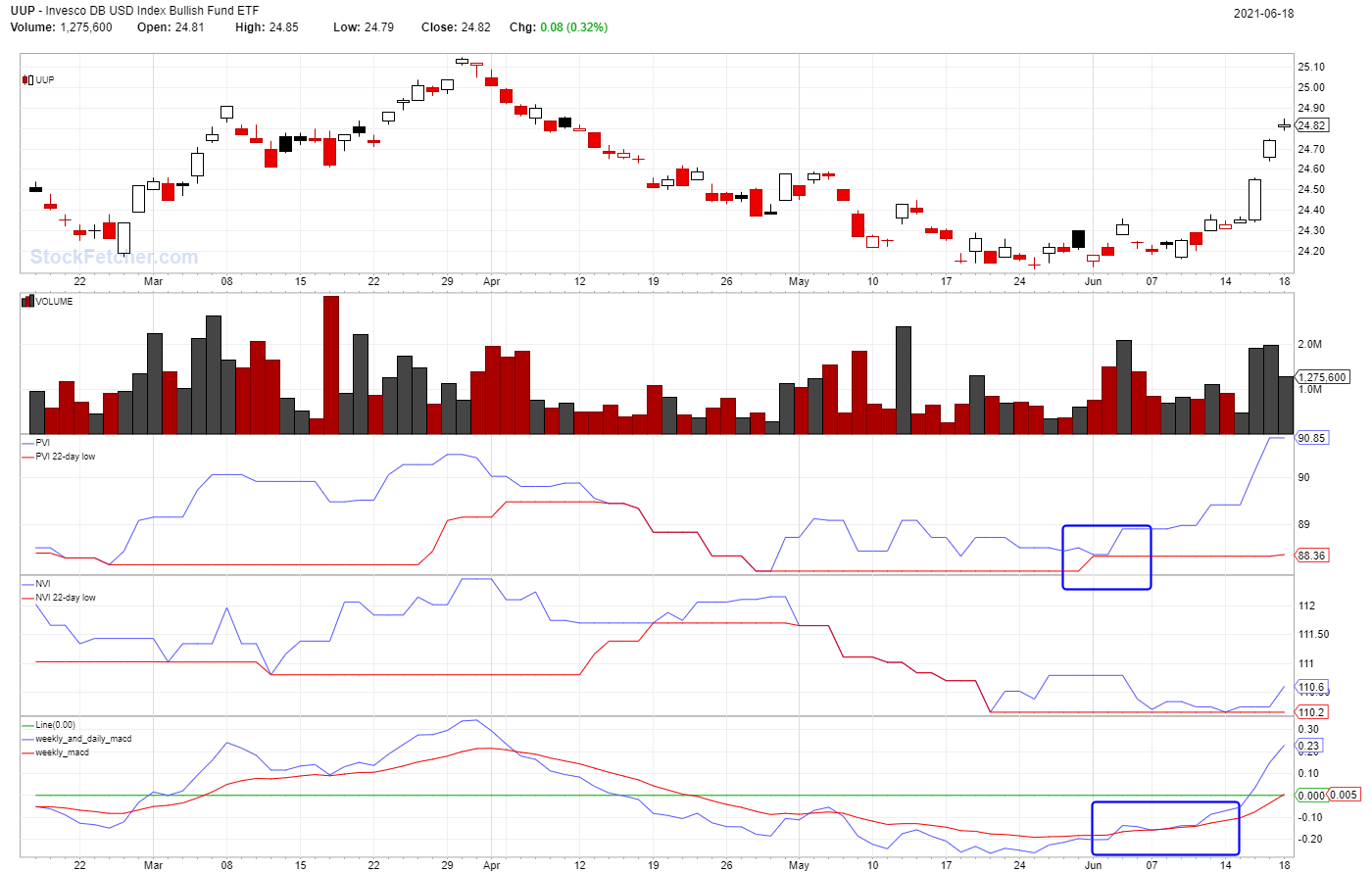

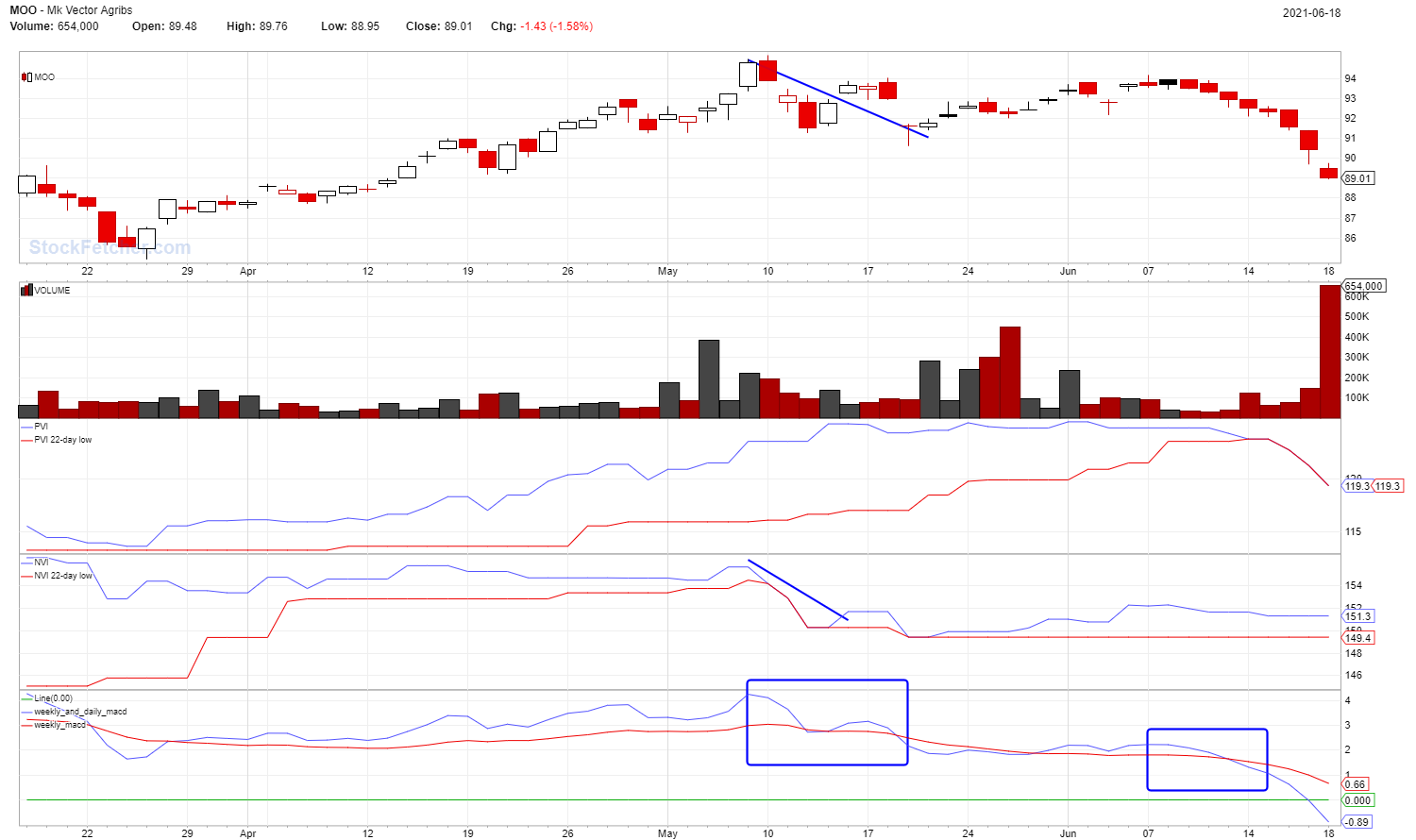

6/19/2021 8:20:20 AM Cheese, concerning MOO and UUP   Just using PVI, NVI and weekly and daily MACD |

| Cheese 1,374 posts msg #157049 - Ignore Cheese |

6/19/2021 12:53:20 PM https://www.stockfetcher.com/forums/General-Discussion/backtesting-ideas/156926/20 snappyfrog 6/19/2021 8:20:20 AM Cheese, concerning MOO and UUP Just using PVI, NVI and weekly and daily MACD ================================================================================== THANK YOU, snappy ! Your stuff is top of the line and top of mind. I'll have to remember to watch stuff like UUP,MOO,AGG,SHY,TLT,TBT,IEF more often https://etfdb.com/etfs/bond/treasuries/ |

| StockFetcher Forums · General Discussion · backtesting ideas | << 1 2 3 4 >>Post Follow-up |