| StockFetcher Forums · General Discussion · Price and what's really being said on the chart. | << >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #154253 - Ignore Mactheriverrat |

10/10/2020 2:12:37 AM On Watch - Don't watch the price , what are the Guppy MMA'S saying on the chart? |

| nibor100 1,102 posts msg #154271 - Ignore nibor100 |

10/10/2020 5:10:15 PM @Mac, In case you haven't already tried this: a. go to settings and eliminate the volume plot b. Use the slider to resize the normal price chart to as small vertically as possible c. After you run the mod of 1 of your recent filters, provided below, resize the Guppy MMAs window to as big as you like d. Only drawback is most of your indicator charts that are below the Guppy chart will be just as big e. I didn't test it on many symbols but I believe it should work on most, the scale is the challenge Ed S. |

| Mactheriverrat 3,178 posts msg #154275 - Ignore Mactheriverrat |

10/10/2020 10:11:32 PM I took and weekly IFT(2,3) is below 1.00 off that symlist filter. |

| nibor100 1,102 posts msg #154276 - Ignore nibor100 |

10/10/2020 11:25:49 PM Did you take a look at the resulting chart that only has Guppy mmas and no PRICE data? thanks, Ed S. |

| Mactheriverrat 3,178 posts msg #154280 - Ignore Mactheriverrat |

10/11/2020 12:26:53 AM Looks great ED. Yes it doesn't show volume but I would like where it doesn't show price. But that's just me. |

| xarlor 641 posts msg #154282 - Ignore xarlor |

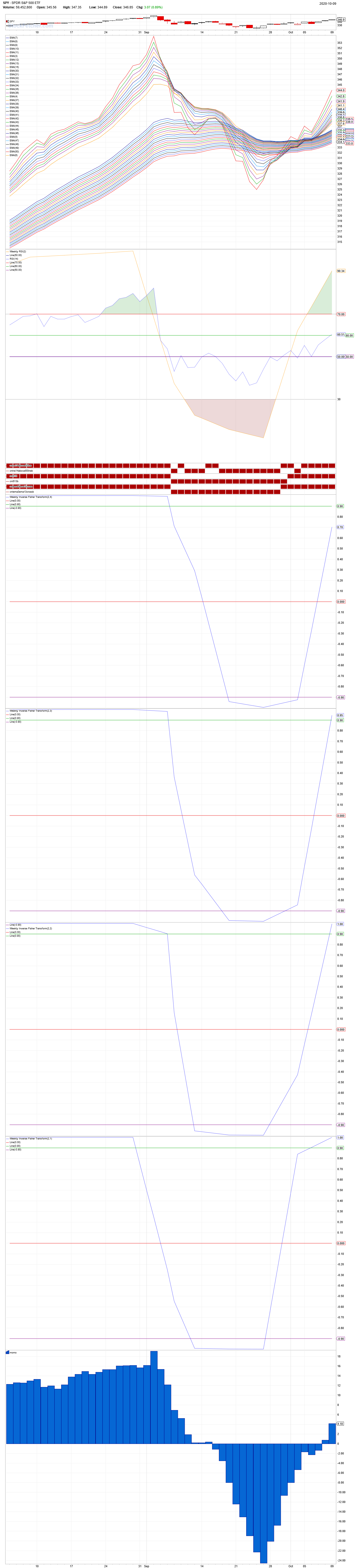

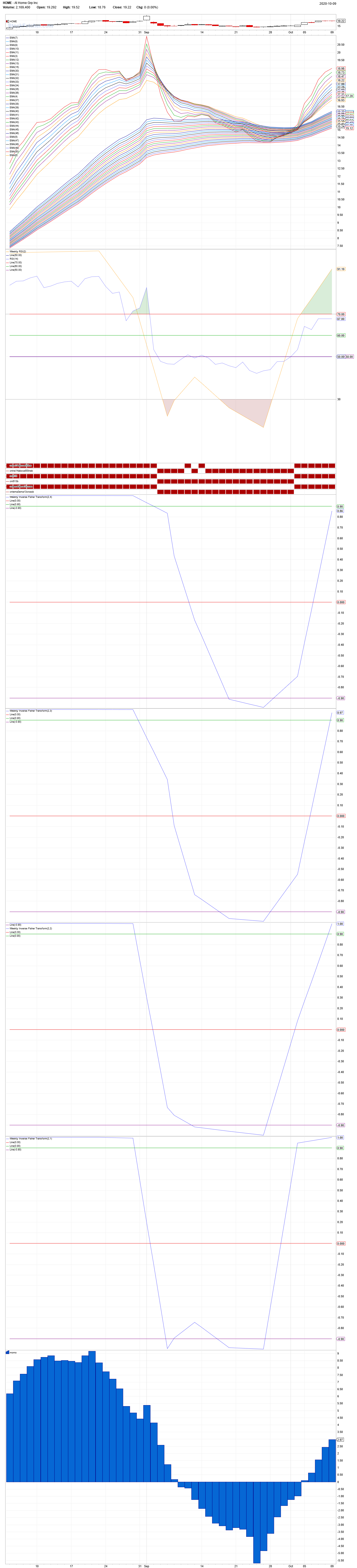

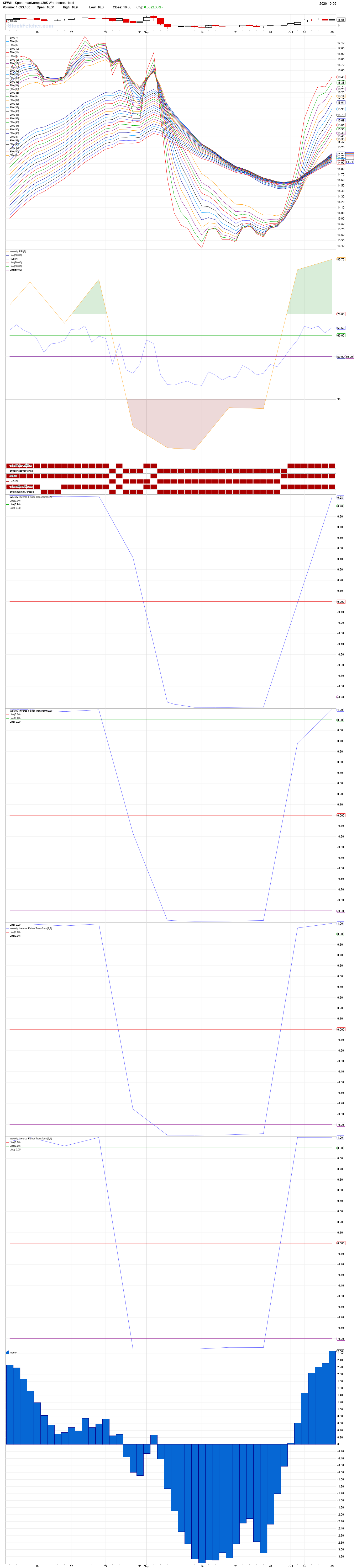

10/11/2020 10:41:58 AM That's the beauty of nibor's filter above. It draws the guppys in its own chart, below the volume bars, but without price as you wished. It's quite ingenious. Your recent favorites are below: SPY, HOME, and SPWH.    |

| Mactheriverrat 3,178 posts msg #154286 - Ignore Mactheriverrat |

10/11/2020 12:58:46 PM Yes Xarlor it is very ingenious of the way Ed filter runs. I've seen it done a few times in some of SF very old posts . Just never clicked in my mind about it. Great code . Thanks again ED!!!!!!!!!! |

| nibor100 1,102 posts msg #154287 - Ignore nibor100 |

10/11/2020 2:01:47 PM Most of the credit goes to the SF user manual page 151 for the DRAW ON phrase. Ed S. |

| StockFetcher Forums · General Discussion · Price and what's really being said on the chart. | << >>Post Follow-up |