| StockFetcher Forums · General Discussion · Monthly Traders Update | << 1 2 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #138434 - Ignore Mactheriverrat modified |

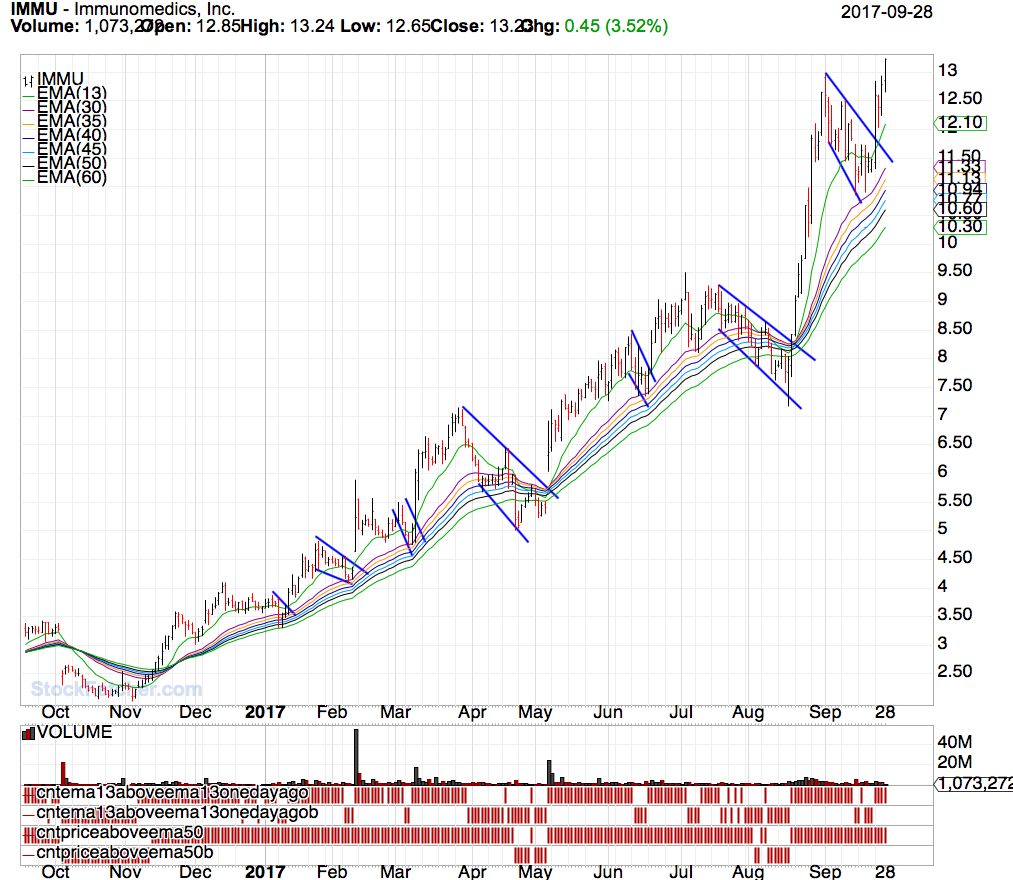

9/28/2017 12:04:17 PM @pthomas Roger on sdn IMMU had a strong price cross above the EMA(13) on 9 /25/2017 I'm still convinced on the longer term Guppy averages (Investor's group) wide apart or expanding as a show strength in trend. Which starts when price cross's ema(50) ( a lot of traders use the ma(50). The most strong cross's of price above ema(13) and playing with ema(9) too which play as a support area in pullbacks. Most remounts in strong uptrends of price above ema(13) or ema(9) with a follow through the next day is buy in point. That can just about go with any up trending stock. I'm just not sold on any indicator's right now but that's not says Charting wealth method doesn't work. The only true indicator is price action. Its like having 100 filter's which bring up the same stocks time and time again. Its what one is using as triggers to get in and get out. If one can make a profit at the end of the day then more power to them.  |

| Mactheriverrat 3,178 posts msg #138436 - Ignore Mactheriverrat |

9/28/2017 12:29:10 PM I got the idea of Guppy long term average's from Daryl Guppy. The use of the EMA(13) from FOUS4trading video's I brought some years ago. ( cost of $450. at that time ) The use of the EMA(9) from Bullsonwallstreet trading course of 1 through 9. (cost of $197.00 at the time ) |

| shillllihs 6,102 posts msg #139170 - Ignore shillllihs modified |

11/8/2017 5:24:55 PM Rounding out October, Shills was the clear winner. What a great climactic finish. November has started out profitable for both Shills & allegedly Kevin. Understandably for Kevin with his extensive tech savvy, but equally amazing considering Shills, while being a mostly A student in grade school, got a 12 on his act. because he was hung over and put B. all the way down for every answer. Didn't matter since I knew I was going to be extremely successful in the family business which I helped grow 700%, so much for going to college. Though the rest of you may add a nugget here and there, I really wish you would try to elevate your game. Many of you have been out here for a decade or so. I'm serious. I would like to learn more from you all. Some advice. Learn to trade one etf and stick with it. Learn the ins andd outs of it. For me Xiv is the way to go. You probably will not get rich trading individual stocks which all have different personalities, plus the increased risk of BK. Just some thoughts. |

| StockFetcher Forums · General Discussion · Monthly Traders Update | << 1 2 >>Post Follow-up |