| StockFetcher Forums · Stock Picks and Trading · Weinstein Strategy Picks | << 1 ... 3 4 5 6 7 ... 8 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #148675 - Ignore Mactheriverrat |

7/24/2019 11:06:49 AM @graf Wasn't it you that was looking at PSX awhile back.  |

| graftonian 1,089 posts msg #148684 - Ignore graftonian |

7/24/2019 2:11:01 PM Roger that, Ed. Back on 7/3 bought a call an sold a week later for 49% gain Right now holding a diagonal spread that is slightly under water (2%). |

| xarlor 639 posts msg #148689 - Ignore xarlor |

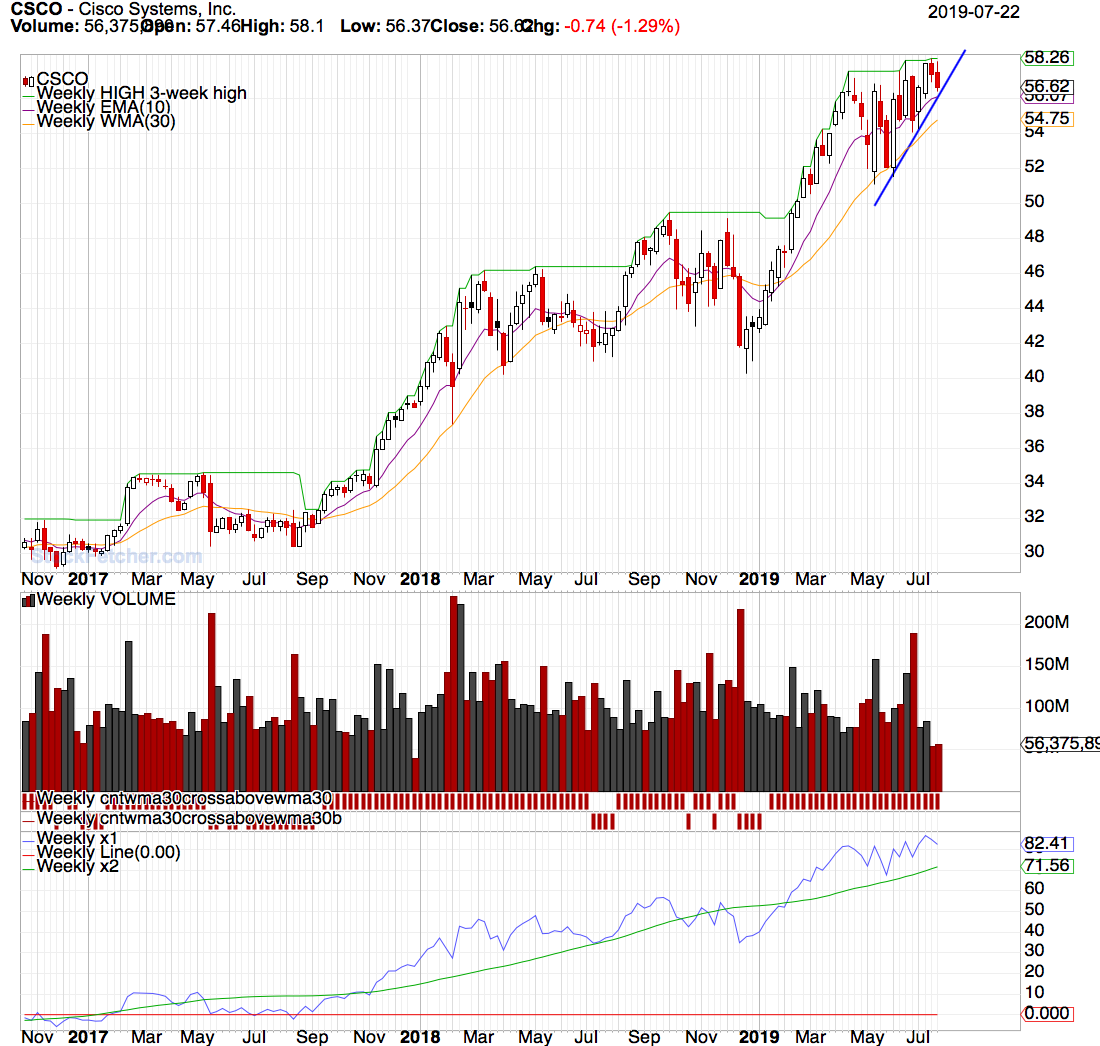

7/25/2019 2:29:17 PM Interesting setup forming on CSCO. On watch as we near earnings.  |

| Mactheriverrat 3,178 posts msg #148691 - Ignore Mactheriverrat |

7/25/2019 5:20:57 PM Weekly chart CSCO Looks good on weekly with ascending triangle .  |

| xarlor 639 posts msg #148749 - Ignore xarlor |

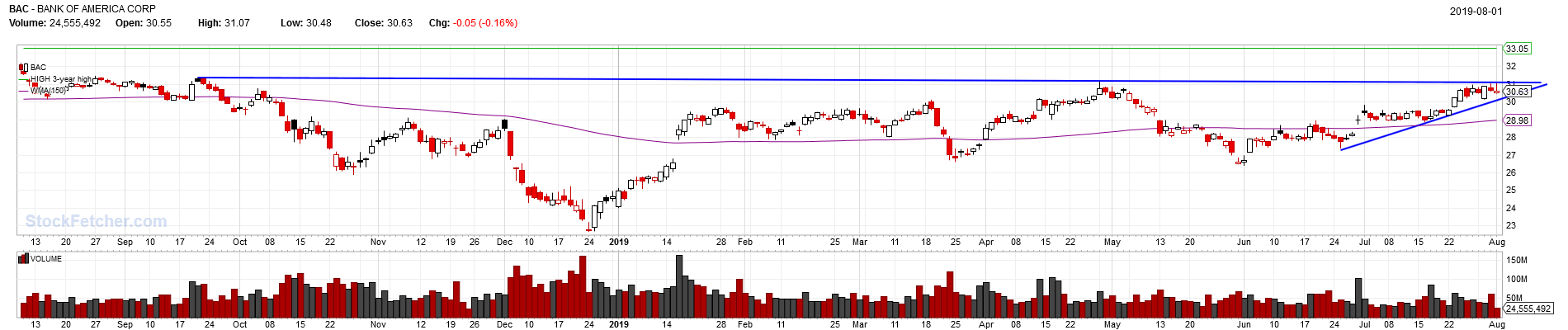

8/1/2019 12:55:58 PM With fed rate cuts, the financial sector historically outperforms. JPM is very close to reaching its all-time high. Every time it breaks its 30-year high JPM makes a huge move up before setting a new all-time high resistance. In the near-term, looking for a breakout above the ascending triangle.  BAC is a sympathy play on the financial sector fed rate cut.  |

| graftonian 1,089 posts msg #148782 - Ignore graftonian |

8/4/2019 11:49:29 AM KNX: A buy at $36.50? |

| xarlor 639 posts msg #148783 - Ignore xarlor modified |

8/4/2019 8:36:52 PM graft, it looks like a good opportunity to buy a Stage 2 on the pullback. The only ingredient missing is that the transportation sector is below the market average and on a general downtrend since January. Still, this past month, Transportation is making a strong rally toward clearing above the market average. All that said I'm going to watch KNX for either a bounce or it breaking its weekly wma 30 before buying. |

| graftonian 1,089 posts msg #148804 - Ignore graftonian |

8/6/2019 10:18:41 AM CPRX earnings tomorrow, hold or sell?????????????? |

| graftonian 1,089 posts msg #148840 - Ignore graftonian modified |

8/8/2019 10:36:50 AM CPRX beat expectations by 3X, and down today. Go figure! ADC approaching last line of restistance at 70 and change, real estate sector doing well, and free money. Will increase my stake if resistance is broken. Comments? Ditto on VER. |

| graftonian 1,089 posts msg #148855 - Ignore graftonian |

8/11/2019 12:21:09 PM With only 8 days till expiration, closed my VER, ADC, and gold positions for a nice profit. We'll see what Monday brings, maybe reestablish positions. FMC and AMD back on the radar. Losers? I got'em Still holding calls on CLF, AES, and NGD PSX, short call expired, maybe sell another call. If I can get a good price, might just break even. |

| StockFetcher Forums · Stock Picks and Trading · Weinstein Strategy Picks | << 1 ... 3 4 5 6 7 ... 8 >>Post Follow-up |