| StockFetcher Forums · Stock Picks and Trading · SHILLS of CHI NEUROTIC NONSENSE SUPERSYSTEM | << 1 2 >>Post Follow-up |

| shillllihs 6,102 posts msg #141850 - Ignore shillllihs modified |

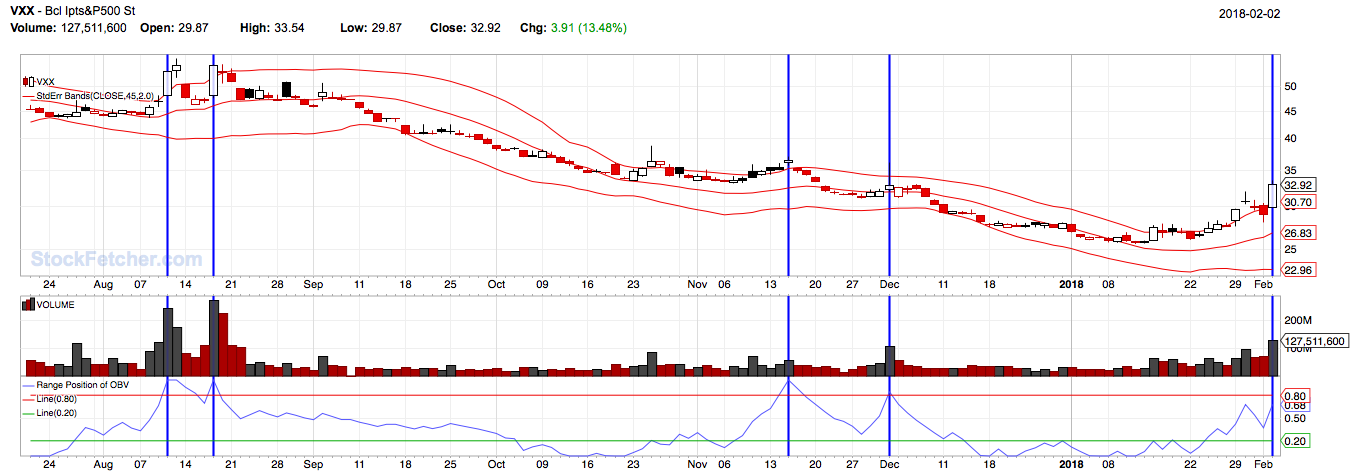

2/4/2018 3:27:59 PM Let’s use Socratic Method. Can you identify entry & exit? Break down the components. Do not take all filter results literally. What do we see kids? |

| Mactheriverrat 3,178 posts msg #141852 - Ignore Mactheriverrat |

2/4/2018 4:22:14 PM Better check you code as it came up. "No Stocks Matched your filter". |

| shillllihs 6,102 posts msg #141854 - Ignore shillllihs |

2/4/2018 4:33:03 PM I just want those to look at the indicators and how they respond particularly to inverse ETFs and Xiv. Look for the repetitive patterns and how some need confirmation. Take your time. |

| shillllihs 6,102 posts msg #141856 - Ignore shillllihs |

2/4/2018 5:10:39 PM Let’s start by looking at shorting UVXY, and why the spike may not be over. Not saying it has more to climb but there are things to look at. And look at what seems to repeat. |

| sandjco 648 posts msg #141861 - Ignore sandjco modified |

2/4/2018 7:18:32 PM  |

| davesaint86 726 posts msg #141862 - Ignore davesaint86 modified |

2/4/2018 7:48:13 PM I currently holding a position in DGAZ. I want to make sure I'm reading the signals right. Is where I placed the two boxes sell and buy signals? Thanks!  |

| shillllihs 6,102 posts msg #141864 - Ignore shillllihs |

2/4/2018 11:24:51 PM Yes, you guys are catching on. You look for both Aroon and Obv to be above upper line while also needing to be at or near upper bb. Or standard error line. You then short down to either of the lower lines. Of Tvix, Uvxy tviz Vxx, only Tvix is above the Obv. line, so I’m waiting for the others to rise before going lions Xiv. You can also look at the rsi rising above 63 then falling below as a short. Virtually has worked every time. |

| pthomas215 1,251 posts msg #141871 - Ignore pthomas215 |

2/5/2018 11:30:58 AM shillihs, that is a nice contribution. why do you use 25 for the aroon? |

| shillllihs 6,102 posts msg #141873 - Ignore shillllihs modified |

2/5/2018 12:26:38 PM It just works for me. This system is my 3rd string, but it works pretty well. Like I said, it’s best when looking at inverse ETFs due to the decay. And yes, as you can see, the wins are nice and the losses are negligible. Not perfect but gets you in at a more optimal level. Couple that with maybe buying at 2 intervals if price goes against you, and you have a winning system. Oh, what I was trying to point out to that guy who made that Neural system, was to wait for NUGT, DRV to hit upper bands and wait for aroon and obv. to climb above upper levels before shorting. If you look at both positions, you would see what I mean and those huge losses would have been mitigated. I was trying to help but ones ego can get in the way. Whatever. If anyone can improve on this, feel free. |

| shillllihs 6,102 posts msg #141877 - Ignore shillllihs |

2/5/2018 1:45:48 PM System seems to work better shorting inverse than long ETFs, but I used another filter that had land long, to short LABU for profit. This system may improve with a better exit, but I don’t want to take a chance and lose wins. All volatility etfs have gone above obv .80 except Uvxy tviz. It’s your choice if you want to enter Xiv now and risk downside or wait it out. But in any case, I’d rather be in Xiv at 107 than 146. Perhaps you can start buying units. |

| StockFetcher Forums · Stock Picks and Trading · SHILLS of CHI NEUROTIC NONSENSE SUPERSYSTEM | << 1 2 >>Post Follow-up |