| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 5 6 7 8 9 ... 63 >>Post Follow-up |

| four 5,087 posts msg #121064 - Ignore four |

7/22/2014 1:50:19 PM |

| four 5,087 posts msg #121102 - Ignore four |

7/25/2014 10:35:34 PM http://www.opensecrets.org/pfds/recent_trans.php |

| four 5,087 posts msg #121105 - Ignore four |

7/26/2014 11:21:18 AM http://www.marketwatch.com/story/buy-and-hold-is-impossible-2014-07-25?siteid=yhoof2 |

| novacane32000 331 posts msg #121122 - Ignore novacane32000 |

7/27/2014 5:15:40 PM Four Do you have a favorite filter for going long-short? |

| four 5,087 posts msg #121123 - Ignore four modified |

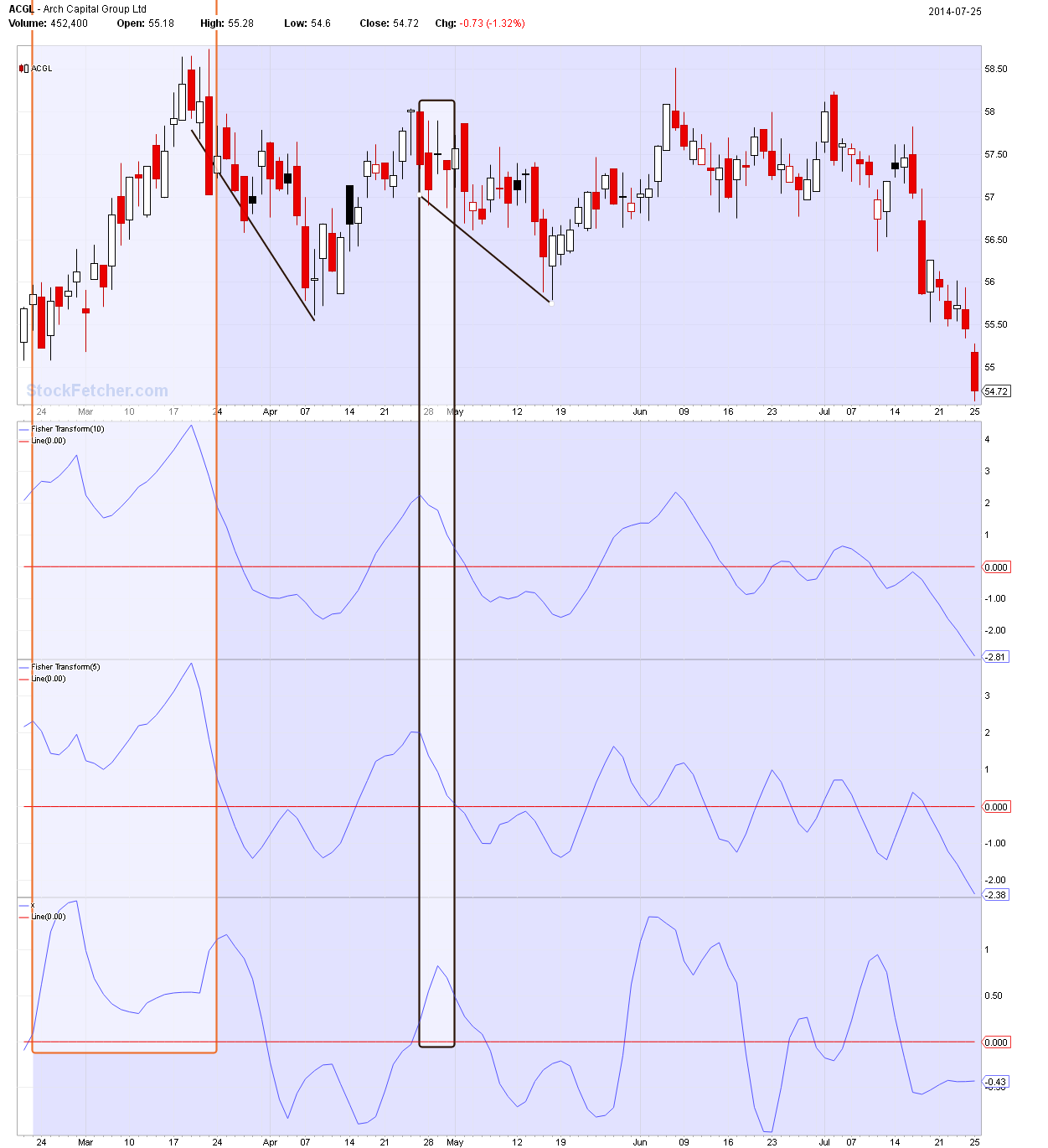

7/27/2014 6:19:00 PM novacane32000, No favorite for long/short. I rarely short. I don't go short unless it pays no dividend. I don't go long unless it pays a dividend. I stay away from OTC. Low > 10. Decent volume. I look for a dip in the short trend while the long trend is keeping the momentum (opposite for short). I enter at the trigger day price (high=long,low=short) or better, next day, with a stop-limit. I exit with a limit. I also find that I will keep setting new trades if the stock is going down (new order based on the new high each day--if long) until it executes. This seems to keep me out of many stocks that react poorly to the filter. You will see a "trend" in the filters posted that reflect the above thesis.I keep my "bet" small (individual stock)) enough that a 50% drawdown doesn't hurt. The dividends keep pumping new money into the 'system. I always have trouble with the exit (win/loss). Perhaps, you can offer your favorites with the rules... or rework one of my posts into something. HTH Here is something you might play with for a short. i would test it visually by moving forward, hence the offset being 100 days. Again, you would keep resetting your order if the filter hits again. I would be interested in a filter that doesn't have to be reset. Does anyone here enter at the trigger and accept an immediate drawdown and exit for a loss? Or set a farther away stoploss and let the stock "meander" for a while? Average up? Average down? Pyramid in either direction? FIRST RECTANGLE: EXAMPLE OF WAITING A WHILE FOR THE SHORT TO BE LARGE AND RUNNING INTO MANY FALSE SIGNALE AND RESETTING THE ORDER Second Rectangle, on the other hand, went much better.  |

| four 5,087 posts msg #121229 - Ignore four |

8/1/2014 11:41:02 PM |

| four 5,087 posts msg #121238 - Ignore four modified |

8/3/2014 12:58:03 PM |

| four 5,087 posts msg #121253 - Ignore four modified |

8/5/2014 12:04:45 AM watch?  |

| djones000buck 206 posts msg #121255 - Ignore djones000buck modified |

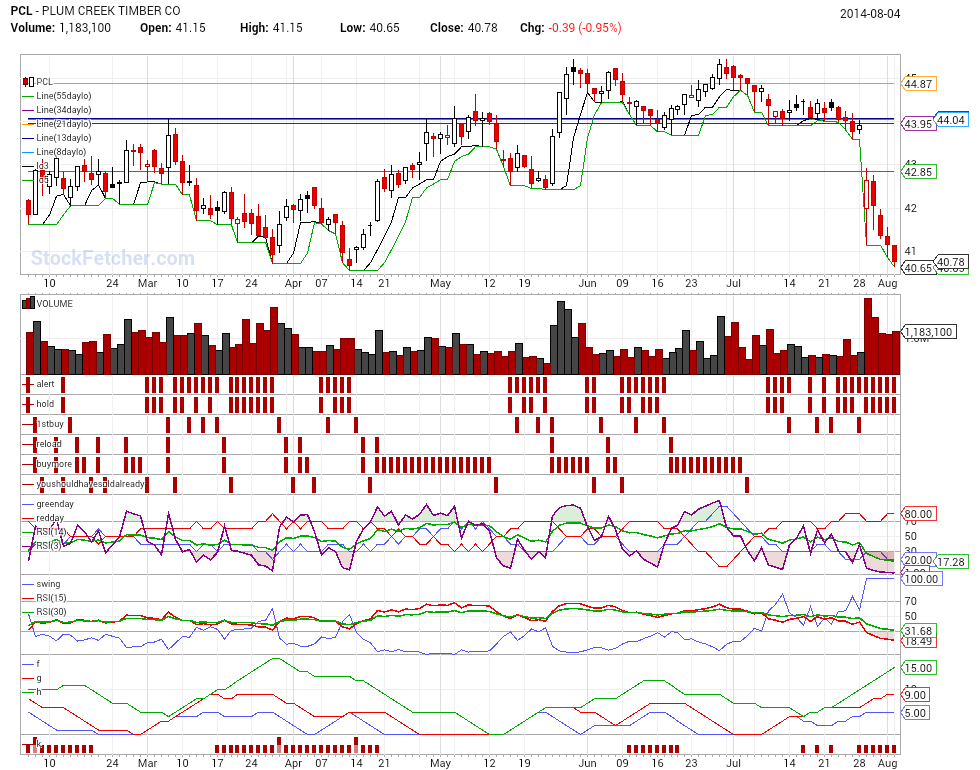

8/5/2014 12:46:50 AM Watch what? Pick a stop and roll lol.. Don't get much prettier than that... One thing I've kept an eye on for a pattern like that is days of overlapping price red red green closes. And the close in or above the overlap. range being the Min hi over 3 days and the max low. Just something I've noticed after a gap down with selling at times. Never been able to code it or provide stats on it. An example for scenario would be amd the day before the 28th in the chart below. Just something I watch for in the 1st buy trigger event... I marked a few days after june 23 as another example.. Glty..  Pcl  edit 8-6 would say it is getting close to bounce territory here. |

| four 5,087 posts msg #121335 - Ignore four |

8/15/2014 9:49:07 AM |

| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 5 6 7 8 9 ... 63 >>Post Follow-up |