| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 26 27 28 29 30 ... 63 >>Post Follow-up |

| four 5,087 posts msg #126497 - Ignore four modified |

12/28/2015 1:02:44 AM    |

| four 5,087 posts msg #126548 - Ignore four modified |

1/1/2016 3:06:43 PM      |

| four 5,087 posts msg #126549 - Ignore four modified |

1/2/2016 1:42:50 AM    |

| four 5,087 posts msg #126550 - Ignore four modified |

1/2/2016 9:15:34 AM    |

| klynn55 747 posts msg #126551 - Ignore klynn55 |

1/2/2016 3:09:22 PM 4: thanks for all the work, but which setup do you like best? |

| four 5,087 posts msg #126552 - Ignore four |

1/3/2016 3:21:47 PM |

| four 5,087 posts msg #126553 - Ignore four modified |

1/3/2016 3:42:42 PM klynn55 413 posts msg #126551 - Ignore klynn55 1/2/2016 3:09:22 PM 4: thanks for all the work, but which setup do you like best? ------------------------ No sarcasm. I do not have a favorite filter. However, as you see I do have a favorite theme. Over the years of being on StockFetcher I have decided on a few things (others have been purged by StockFetcher, first posts were around 2009- http://www.stockfetcher.com/forums2/General-Discussion/Direct-Access-Brokers/81616): Short or Long 1. trade small in relation to account 2. usually no more than three indicators 3. usually not day trade more medium to long 4. enter with stoplimit 5. close with limit 6. +/- a few pennies to the low or high of 1 day ago 7. must make sense visually (see on a chart) 8. use a discount broker and free ETFs (ie reduce "drag"/expenses) 9. trade with trend Long 1. trade only dividend and liquid (ie SP500 and Nasdaq100) 2. trade long usually 3. a high and then a pullback without making new low Short 1. trade only non-dividend and liquid (ie SP500 and Nasdaq100) 2. a low and then a pullback without making new high I am still trying to get comfortable with an exit rule (or rules). I usually hold a loss too long and give-up a win too soon. Guilty of paralysis through analysis. https://www.goodreads.com/work/quotes/97175-reminiscences-of-a-stock-operator http://www.ino.com/blog/2009/10/from-gambling-to-trading-mindset-shifts-that-help-you-win/#.VomJNFmlu1A I now notice this idea (trade around the core): I wonder: http://seekingalpha.com/article/3183086-union-pacific-how-to-trade-around-a-core-position http://www.infobarrel.com/Advantage_of_Trading_Around_a_Core_Stock_Position http://chrisgrande.com/2011/04/25/core-position-vs-trading-position/ http://video.cnbc.com/gallery/?video=3000185991 (forget who the presenter is) I have been wondering how this method works with me and how I think about trading and investing. |

| four 5,087 posts msg #126581 - Ignore four |

1/4/2016 7:51:55 PM |

| four 5,087 posts msg #126607 - Ignore four modified |

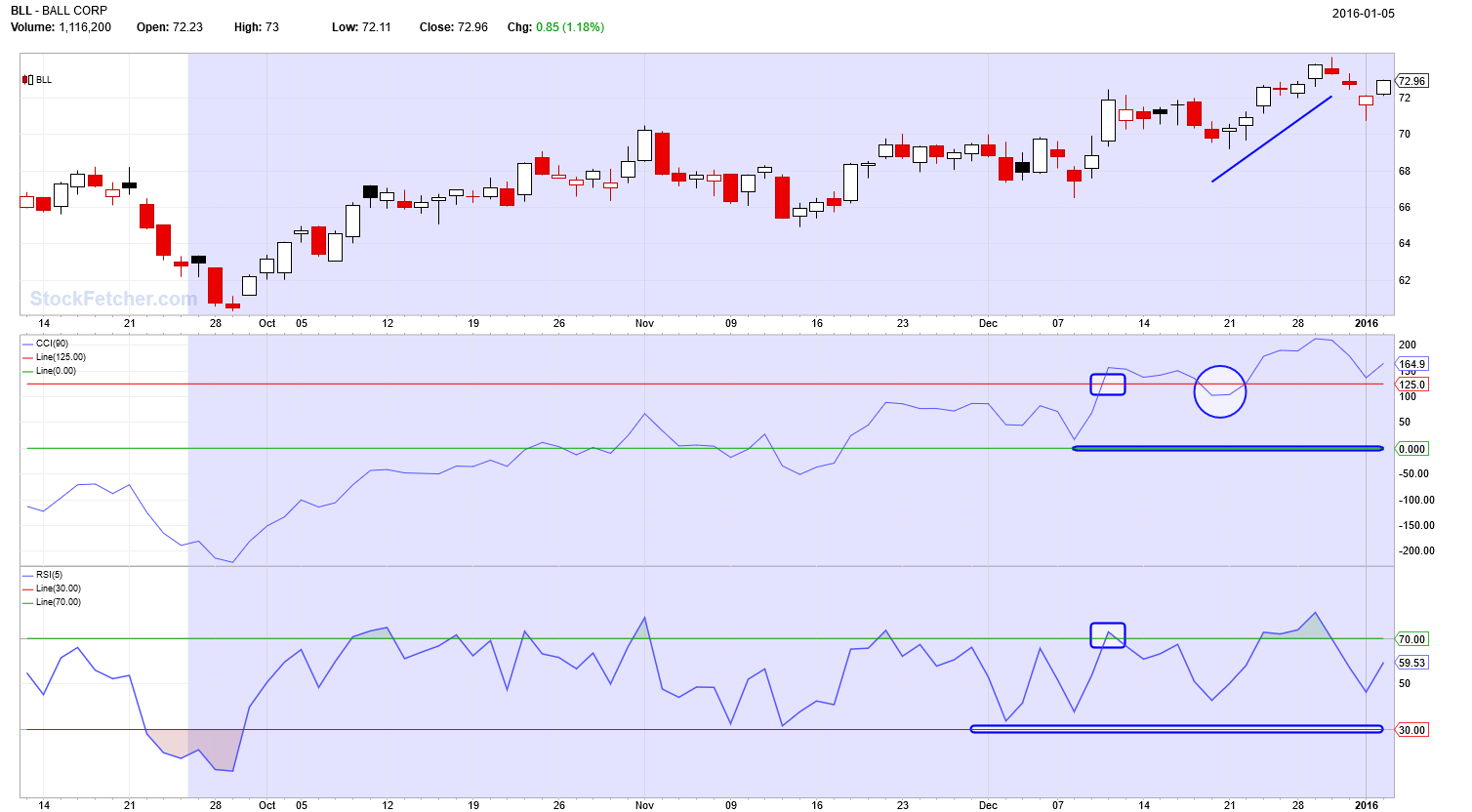

1/6/2016 12:17:20 AM ** 1st chart [short] rsi and cci make low cci cross above 0 and rsi does not reach 70 ** 2nd chart [long] rsi and cci make high cci cross below 125 and rsi does not reach 30   |

| four 5,087 posts msg #126608 - Ignore four modified |

1/6/2016 12:55:04 AM  |

| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 26 27 28 29 30 ... 63 >>Post Follow-up |