| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 43 44 45 46 47 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #149288 - Ignore sandjco modified |

10/5/2019 5:11:35 PM Thanks Cheese and Xarlor Here is RSI 14 on SPY...haven't used RSI 14 for a long while as I've found it too slow to compound but I should pay attention to it.  Where while it go next? Mixing Cheese's and Xarlors inputs...gives me My usual issue...how to find the babes amongst the candidates... As always, I am open to feedback! Thank you in advance. |

| xarlor 639 posts msg #149290 - Ignore xarlor |

10/5/2019 6:03:57 PM Added two lines at the bottom to tighten up the number of results. |

| Cheese 1,374 posts msg #149291 - Ignore Cheese |

10/5/2019 6:45:49 PM sandjco and xarlor, T A wise, I like your fiters. Thank you for sharing. You guys are becoming the real valued "go to" members of this forum. But there are some non-TA black swans and orange swans that are always in the back of my mind. Some market bears expect the upcoming high level US-China trade talks on Oct 10-11 to likely disappoint with no major trade concessions from China. Rather, China may only offer to help tamp down on the opioid crisis and to buy only a moderate amount of US agricultural goods that China needs. Last Friday. Putin pre-empted all this with his announcement that China has agreed to buy from Russia all the soybean and other agricultural goods that it needs. Tweets trump T A dny day. |

| Cheese 1,374 posts msg #149292 - Ignore Cheese |

10/5/2019 11:50:41 PM sandjco, According to some trading posts that I've read, StockTA provides the best support and resistance lines, apparently in a smart way, i.e. only where appropriate. StockTA Trend Analysis: Performs linear regression on short term (20 day), intermediate term (60 day) and long term (120 day) high and low analysis to determine if trend lines (rSquare>0.8) and channels exists. The slope is the daily gain (-loss) of the trend line.Alerts include existence of trend channels and recent break outs. As an example, at the time of writing, StockTA shows support and resistance lines for XLRE http://www.stockta.com/cgi-bin/analysis.pl?symb=XLRE&mode=table&table=trend StockTA has never asked me for personal info, credit card or donation, but it is the labor of love of one man band, so sometimes during peak trading hours, the site may not be able to handle the load. GLTY |

| sandjco 648 posts msg #149294 - Ignore sandjco |

10/6/2019 10:30:12 AM Thank you both. Xarlor, I will add a volume component but didn't add the moving average. Cheese, thank you for your kind words. I have a long way to go; 3 x 100% gains in a few days is an aberration and statistically difficult to sustain. Albeit, this year has weird...I made more with less trades and all were index plays done with options (which is not what I started to do). Thanks for the StockTA link. I am not even close yet. You and few others who have been here a while keep the community robust and do add value. Regarding your comments about Black Swans and tweets, I for sure can understand. The XIV debacle not too long ago was a good reminder. Given the current Global market and the proliferation of social media, you are correct, a crazy tweet can wreck a good position. However, I do see that as an opportunity as well. But it does force you to tighten your risk tolerance (hence, I didn't want to hold a large profitable position over the weekend and decided to shed a majority of it instead of being greedy). I don't know how to post what was generated by the screener but these were the two that caught my eye:   Trade war, talk of recession, impeachment...doesn't seem to take SPY below 280. Earnings season coming up. 280 or 302? Guess, I shouldn't really care...I should trade what I'm given. Good luck all! |

| sandjco 648 posts msg #149313 - Ignore sandjco |

10/7/2019 6:48:20 PM No follow thru. All cash now. |

| sandjco 648 posts msg #149317 - Ignore sandjco |

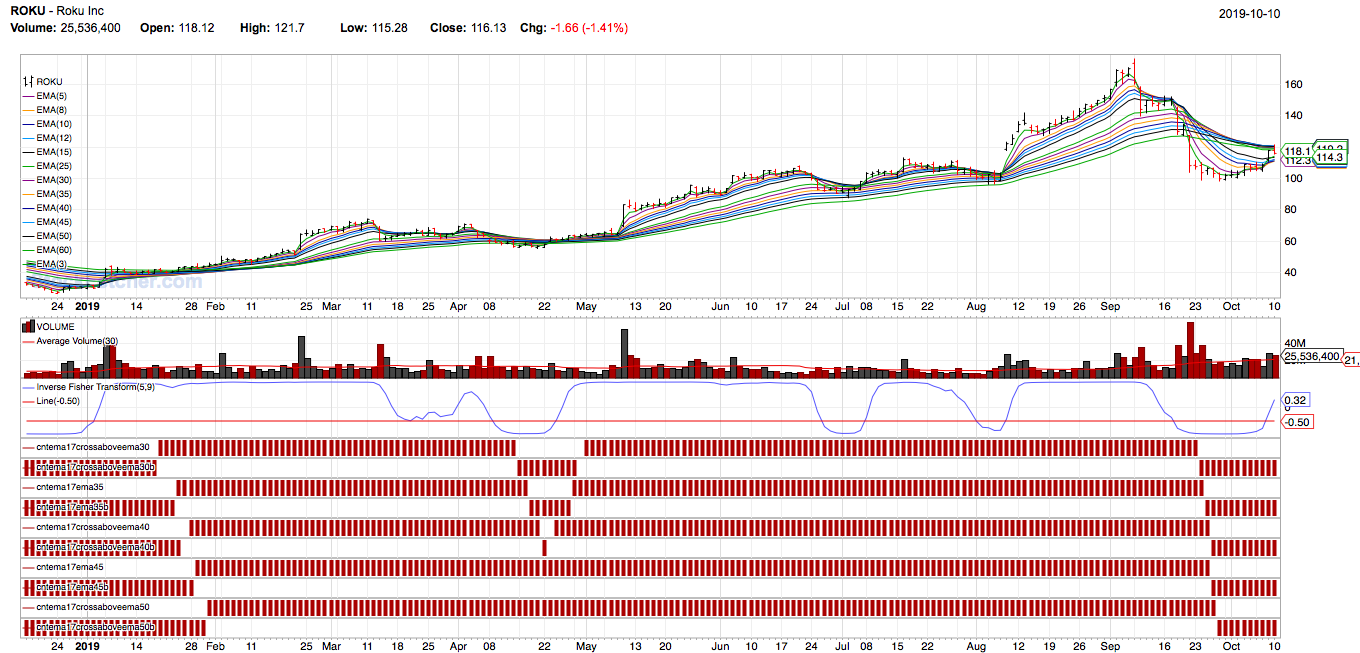

10/11/2019 8:38:02 AM Oct 25 116C |

| sandjco 648 posts msg #149325 - Ignore sandjco modified |

10/12/2019 10:54:55 AM Hmm...that faded away. Uh oh. Long QQQ Nov 197C Sold 3/4 of ROKU calls for 50% plus gain. |

| sandjco 648 posts msg #149354 - Ignore sandjco |

10/15/2019 9:41:51 PM  |

| sandjco 648 posts msg #149483 - Ignore sandjco modified |

10/28/2019 9:08:45 PM Closed QQQ; all cash  No sell signal; just didn't want to give back what Ms. Market generously gave! |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 43 44 45 46 47 ... 48 >>Post Follow-up |