| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 35 36 37 38 39 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #145718 - Ignore sandjco |

12/26/2018 3:51:15 PM what's FAGIX shills? Will use EOD prices; added TQQQ today. |

| shillllihs 6,102 posts msg #145719 - Ignore shillllihs |

12/26/2018 4:29:25 PM Just a bond fund that when it drops under 10, the market tanks. I like looking for patterns so this is just a guide. I shorted a bunch of things today. If you have enough money to keep buying on dips then tqqq is ok I guess, I don’t know anything but I think tqqq could go to 21-22 I think Dgaz is a great overall short. |

| sandjco 648 posts msg #145832 - Ignore sandjco |

1/2/2019 4:43:06 PM Out TQQQ using $37.57 EOD. |

| sandjco 648 posts msg #145835 - Ignore sandjco |

1/2/2019 5:55:56 PM Happy New Year! So my kids can follow my insanity... $2,000 at $48.12 $3,000 at $44.77 $5,000 at $40.13 1st $10,000 tranche $2,000 at $36.33 $3,000 at $32.82 (not posted over the holidays) $5,000 at $30.39 (not posted over the holidays) 2nd $10,000 tranche approximate ACB $36.76. Hence, my "flight" instincts told me to sell while I'm break even. RSI(2) was over 87 and the market reversed today from a red opening. What have I fixed? - Pay attention to market direction. Mac's Guppy have clearly shown the market turning down and yet I continued to "mechanically" follow the plan (which could have been a nightmare). - I have filtered to only include ETFs that are above the 200MVA - in hindsight, that was crazy... Still need to be fixed... - my mindset when it comes to pulling the trigger (overstay when the position is against me) DGAZ still going at $122 or $6.10 bfore the 20/1 reverse split! Lucky on this? |

| sandjco 648 posts msg #145845 - Ignore sandjco |

1/2/2019 10:45:31 PM AAPL warns for the first time since 2007. When they took the step to take out detailed disclosure on units sold...that was a good hint?  Throw baby with the bath water time? China slowdown? Thank Trump? |

| sandjco 648 posts msg #145903 - Ignore sandjco modified |

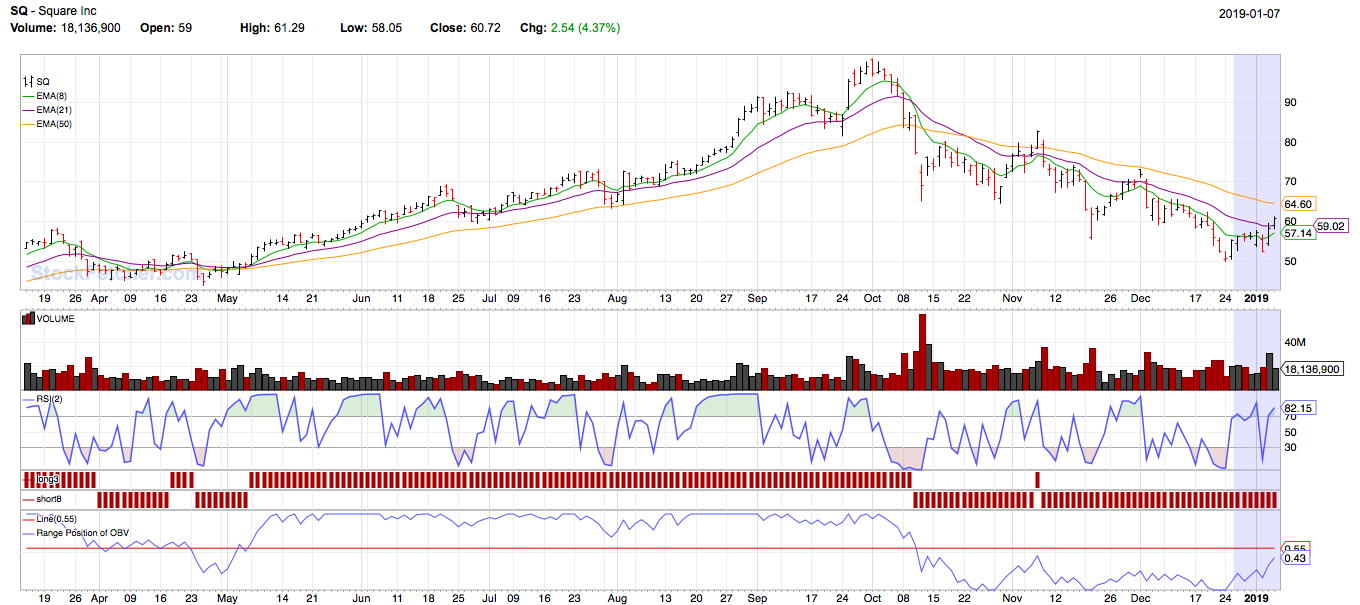

1/7/2019 12:25:39 PM Picked up BL, GOOG, TWLO, SQ and MSFT; will use EOD. |

| sandjco 648 posts msg #145912 - Ignore sandjco modified |

1/8/2019 8:54:31 AM      |

| sandjco 648 posts msg #146138 - Ignore sandjco |

1/18/2019 12:42:54 PM Picked up STZ |

| sandjco 648 posts msg #146153 - Ignore sandjco |

1/19/2019 9:32:33 AM Lessons learned in 2018: - DMA was not a good indicator for me - one may be right in thinking the sky ain't falling but NEVER ignore the trend as it can keep on going for a while which means opportunity lost. - Any indicator in isolation will not help; in my case using RSI to build a position in a downtrend. - scaling in and position sizing helped So, the hunt for a simple "mechanical" plan continues! |

| sandjco 648 posts msg #146155 - Ignore sandjco modified |

1/19/2019 12:06:32 PM Looking for feedback from Options inclined traders...  AMZN is about to report earnings in 2 weeks. However, unless my eyesight is failing me and missed something, there was a $6.7MM trade 1710/1720 PUT expiring Feb 1st. $60ish premium paid. Seems to go agains the grain in my newbie brains...what am I missing? Thank you Replaced my stock purchase of STZ with STZ Jan 2020 160C using $20.30 so I can free up cash ;=P |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 35 36 37 38 39 ... 48 >>Post Follow-up |